Dow Jones vs Bananas

#11

I used the absolutely and thoroughly disgusting true story of the LIBOR manipulation as a proxy for my contention. Additionally, Google: "the Greenspan Put".

You say the indicies aren't manipulated? What do you call "too-big-to-fail" and all the bank bailouts, then? Had the banks not been bailed out and allowed to fail (ie. "free market" = no intervention), where do you think the DOW might be today?

A: Sure as heck not setting new all-time highs.

Yes, the markets are most definitely manipulated. There is NO question of it. LIBOR and "too-big-to-fail" are the best known examples of it. There are plenty more. Research how the Silver market has been manipulated, and/or how the world's central banks are manipulating the price of Gold (hint: the price of Gold is a proxy for how "the markets" judge Central Bank(s) policy....read: rising Gold prices are a repudiation of Central Bank policy).

The evidence is overwhelming...and making money "trading" the indices doesn't preclude these facts in any way.

You say the indicies aren't manipulated? What do you call "too-big-to-fail" and all the bank bailouts, then? Had the banks not been bailed out and allowed to fail (ie. "free market" = no intervention), where do you think the DOW might be today?

A: Sure as heck not setting new all-time highs.

Yes, the markets are most definitely manipulated. There is NO question of it. LIBOR and "too-big-to-fail" are the best known examples of it. There are plenty more. Research how the Silver market has been manipulated, and/or how the world's central banks are manipulating the price of Gold (hint: the price of Gold is a proxy for how "the markets" judge Central Bank(s) policy....read: rising Gold prices are a repudiation of Central Bank policy).

The evidence is overwhelming...and making money "trading" the indices doesn't preclude these facts in any way.

#12

I used the absolutely and thoroughly disgusting true story of the LIBOR manipulation as a proxy for my contention. Additionally, Google: "the Greenspan Put".

You say the indicies aren't manipulated? What do you call "too-big-to-fail" and all the bank bailouts, then? Had the banks not been bailed out and allowed to fail (ie. "free market" = no intervention), where do you think the DOW might be today?

A: Sure as heck not setting new all-time highs.

Yes, the markets are most definitely manipulated. There is NO question of it. LIBOR and "too-big-to-fail" are the best known examples of it. There are plenty more. Research how the Silver market has been manipulated, and/or how the world's central banks are manipulating the price of Gold (hint: the price of Gold is a proxy for how "the markets" judge Central Bank(s) policy....read: rising Gold prices are a repudiation of Central Bank policy).

The evidence is overwhelming...and making money "trading" the indices doesn't preclude these facts in any way.

You say the indicies aren't manipulated? What do you call "too-big-to-fail" and all the bank bailouts, then? Had the banks not been bailed out and allowed to fail (ie. "free market" = no intervention), where do you think the DOW might be today?

A: Sure as heck not setting new all-time highs.

Yes, the markets are most definitely manipulated. There is NO question of it. LIBOR and "too-big-to-fail" are the best known examples of it. There are plenty more. Research how the Silver market has been manipulated, and/or how the world's central banks are manipulating the price of Gold (hint: the price of Gold is a proxy for how "the markets" judge Central Bank(s) policy....read: rising Gold prices are a repudiation of Central Bank policy).

The evidence is overwhelming...and making money "trading" the indices doesn't preclude these facts in any way.

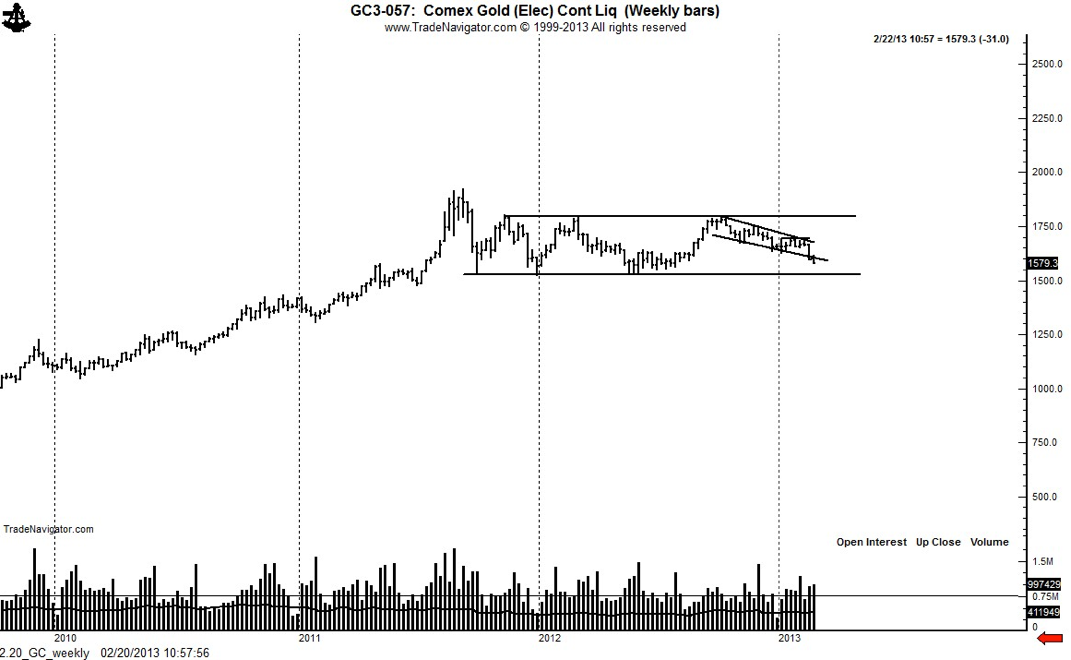

FWIW: Notice the oscillation between about 1550 and about 1800 since 2011. If you like investing in gold it might have just put in a local bottom.

WW

#13

I used the absolutely and thoroughly disgusting true story of the LIBOR manipulation as a proxy for my contention. Additionally, Google: "the Greenspan Put".

You say the indicies aren't manipulated? What do you call "too-big-to-fail" and all the bank bailouts, then? Had the banks not been bailed out and allowed to fail (ie. "free market" = no intervention), where do you think the DOW might be today?

A: Sure as heck not setting new all-time highs.

Yes, the markets are most definitely manipulated. There is NO question of it. LIBOR and "too-big-to-fail" are the best known examples of it. There are plenty more. Research how the Silver market has been manipulated, and/or how the world's central banks are manipulating the price of Gold (hint: the price of Gold is a proxy for how "the markets" judge Central Bank(s) policy....read: rising Gold prices are a repudiation of Central Bank policy).

The evidence is overwhelming...and making money "trading" the indices doesn't preclude these facts in any way.

You say the indicies aren't manipulated? What do you call "too-big-to-fail" and all the bank bailouts, then? Had the banks not been bailed out and allowed to fail (ie. "free market" = no intervention), where do you think the DOW might be today?

A: Sure as heck not setting new all-time highs.

Yes, the markets are most definitely manipulated. There is NO question of it. LIBOR and "too-big-to-fail" are the best known examples of it. There are plenty more. Research how the Silver market has been manipulated, and/or how the world's central banks are manipulating the price of Gold (hint: the price of Gold is a proxy for how "the markets" judge Central Bank(s) policy....read: rising Gold prices are a repudiation of Central Bank policy).

The evidence is overwhelming...and making money "trading" the indices doesn't preclude these facts in any way.

Scare quotes and capital letters are just bluster.

Strongly held opinions are not the same thing as well-reasoned arguments.

I agree with you that there is manipulation by big players in the financial system. Government regulators, mega-corporations, and central banks are some combination of stupid, inefficient, and corrupt. I think stock indices, due to the transparency of their construction and the breadth of their holdings, have as limited an exposure to manipulation as is possible. These indices are neither worthless nor meaningless.

WW

Thread

Thread Starter

Forum

Replies

Last Post