Delta Pilots Association

#4011

In no particular order:

1)Pay

2)Fix the reserve system

3)Scope

4)Fill me to 415 limits

The concession I will be willing to give is:

1)alpa national

Anybody care to add to this list?

#4012

That is a ridiculous argument.... and one, I might add, that you like to use.As a matter of fact, I defy you to find 12,000 different priorities. I'll bet you can't realistically find many more than about 10. I'd even be surprised if there were THAT many.. but there are some screwballs out there that might want to work more days/month or more hours.. or something like that. So.. why don't we start the list?.

In no particular order:

1)Pay

2)Fix the reserve system

3)Scope

4)Fill me to 415 limits

The concession I will be willing to give is:

1)alpa national

Anybody care to add to this list?

In no particular order:

1)Pay

2)Fix the reserve system

3)Scope

4)Fill me to 415 limits

The concession I will be willing to give is:

1)alpa national

Anybody care to add to this list?

Pay increase of at least XX% with annual raises of XX% (I like 80% and 5% plus any gains in the euro) or AF/KLM plus X%

Put seniority back into the reserve system, offer split reserve/regular lines, 12 hour short call 6X/month for both dom and int'l, make the whole process of trip assignment transparent, etc.

Scope recapture: including everything flown at mainline seat wise, the ALK outsource repaired so there is a benefit to the DAL pilots.

415C limit is clear enough.

Later ALPA nat'l.

#4014

THAT is very interesting.... I still think the longevity based system is the way to go... but I know that is tilting at windmills... but your idea is very interesting...

#4015

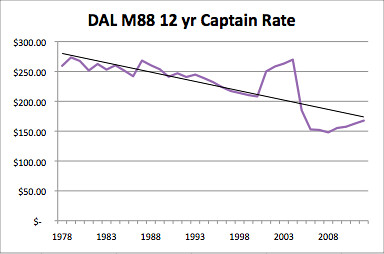

That's a very informative chart. Thanks, PG.

Here's my take on it. The chart starts in 1978. It would be interesting to see what it looked like prior to that (essentially, prior to deregulation). I suspect it would have some significant gains in the early to mid 20th century and then stay relatively flat (at about the buying power of 1978) through the 60's and 70's. That was definitely the "hey day" for airline pilots in terms of buying power. My opinion is that the "value" of an airline pilot had been written in blood and pretty well established by the time we got to the 60's and 70's. Safety was by far the #1 priority and airline pilot compensation reflected that. Then came deregulation. You take an industry that had been subsidized by the government and very poorly managed (didn't have to manage it well because the profits were virtually guaranteed). Suddenly, these companies have to actually compete in a free market. (Well sorta... airlines are still heavily regulated in many areas.) Anyway, it's literally taken decades for this industry to slowly recognize some of it's management flaws and begin to correct them. Then you add in the sense of entitlement to low airfares that people seem to have... and you have an industry that has allowed a real problem to develop in terms of the cost/revenue equation.

My take on PG's slowly declining buying power graph is that it reflects both the realities of the industry and ALPA's inability to effectively make the case for maintaining the value of airline pilots. I see C2K as simply a correction to get our buying power back to the well established value that we saw in the 60's and 70's. If you look at the graph, you can see that C2K set that buying power back to exactly what it was in 1978 before the decline started.

Then 9/11 happened. And we got into an era of irresponsible bean counting... disregarding tried and true business principles with a focus on short term performance numbers and stock price (instead of doing what is best for the company in the long run) and maximizing executive compensation. These bean counters have just about ruined our product (I'm talking the whole industry, not just Delta) and have turned employees into strictly a cost item, missing out on the real value of employees as one of the most important assets to the company.

The cuts we took just prior to and during BK were unprecedented and unwarranted. There is no way you can justify those massive cuts with a slowly declining line on a graph. What I think most of us are advocating is that we return that line on the graph to at or near that well established level of value that had been established for us for decades prior to 1978... you know, back when the overriding priority in the industry was safety, which includes having the best people possible in the cockpit. That's what I want to see from ALPA. I want them to make the case that what we do is no less valuable today than it was in 1978.

Sorry if I rambled a bit in this post... but I do not in any way believe that we have to accept a 50% reduction in the value of the career we signed up for. And I think we need to be realistic about the kind of numbers (increase) it will take to restore that reduction. Hint: It is not going to be accomplished with a "what are you willing to give up to get that" mentality.

Here's my take on it. The chart starts in 1978. It would be interesting to see what it looked like prior to that (essentially, prior to deregulation). I suspect it would have some significant gains in the early to mid 20th century and then stay relatively flat (at about the buying power of 1978) through the 60's and 70's. That was definitely the "hey day" for airline pilots in terms of buying power. My opinion is that the "value" of an airline pilot had been written in blood and pretty well established by the time we got to the 60's and 70's. Safety was by far the #1 priority and airline pilot compensation reflected that. Then came deregulation. You take an industry that had been subsidized by the government and very poorly managed (didn't have to manage it well because the profits were virtually guaranteed). Suddenly, these companies have to actually compete in a free market. (Well sorta... airlines are still heavily regulated in many areas.) Anyway, it's literally taken decades for this industry to slowly recognize some of it's management flaws and begin to correct them. Then you add in the sense of entitlement to low airfares that people seem to have... and you have an industry that has allowed a real problem to develop in terms of the cost/revenue equation.

My take on PG's slowly declining buying power graph is that it reflects both the realities of the industry and ALPA's inability to effectively make the case for maintaining the value of airline pilots. I see C2K as simply a correction to get our buying power back to the well established value that we saw in the 60's and 70's. If you look at the graph, you can see that C2K set that buying power back to exactly what it was in 1978 before the decline started.

Then 9/11 happened. And we got into an era of irresponsible bean counting... disregarding tried and true business principles with a focus on short term performance numbers and stock price (instead of doing what is best for the company in the long run) and maximizing executive compensation. These bean counters have just about ruined our product (I'm talking the whole industry, not just Delta) and have turned employees into strictly a cost item, missing out on the real value of employees as one of the most important assets to the company.

The cuts we took just prior to and during BK were unprecedented and unwarranted. There is no way you can justify those massive cuts with a slowly declining line on a graph. What I think most of us are advocating is that we return that line on the graph to at or near that well established level of value that had been established for us for decades prior to 1978... you know, back when the overriding priority in the industry was safety, which includes having the best people possible in the cockpit. That's what I want to see from ALPA. I want them to make the case that what we do is no less valuable today than it was in 1978.

Sorry if I rambled a bit in this post... but I do not in any way believe that we have to accept a 50% reduction in the value of the career we signed up for. And I think we need to be realistic about the kind of numbers (increase) it will take to restore that reduction. Hint: It is not going to be accomplished with a "what are you willing to give up to get that" mentality.

#4016

All you corporate tax gurus:

The US corporate tax rate is 35% for anything over $18.3mil...

So does that mean that for every $1.00 of expenses (i.e. pilot contract costs), that the "real cost" to the company is only $0.65?

i.e. Increase in pilot wages by $2 Billion per year would mean a "true cost" to the company of only $1.3 billion per year?

Am I doing that math correctly?

The US corporate tax rate is 35% for anything over $18.3mil...

So does that mean that for every $1.00 of expenses (i.e. pilot contract costs), that the "real cost" to the company is only $0.65?

i.e. Increase in pilot wages by $2 Billion per year would mean a "true cost" to the company of only $1.3 billion per year?

Am I doing that math correctly?

#4017

All you corporate tax gurus:

The US corporate tax rate is 35% for anything over $18.3mil...

So does that mean that for every $1.00 of expenses (i.e. pilot contract costs), that the "real cost" to the company is only $0.65?

i.e. Increase in pilot wages by $2 Billion per year would mean a "true cost" to the company of only $1.3 billion per year?

Am I doing that math correctly?

The US corporate tax rate is 35% for anything over $18.3mil...

So does that mean that for every $1.00 of expenses (i.e. pilot contract costs), that the "real cost" to the company is only $0.65?

i.e. Increase in pilot wages by $2 Billion per year would mean a "true cost" to the company of only $1.3 billion per year?

Am I doing that math correctly?

#4018

DAL wants debt to be at or under 10bill by 2012...when we actually are amendable (Jan. 2013) the debt will likely be in the 7.5-8 Billion range. That will represent roughly debt service savings of roughly $900 million per year.

With a stable industry and profits in the 1.5-2.5 billion per year range, that would mean about 2.4-3.4 billion per year in available funds.

IF the restoration of C2K rates will cost roughly 18-19mil per percentage point...63% (for restoration + COLA):

Cost $1.20 Billion roughly

Get DC to 18%: (4% more) ADD 80 mil

Roughly $1.28 billion per year rates/ret. ONLY

Using the corporate tan math from above, the "true cost" of this increase is

1.280bn x 65% = $832,000,000 per year.

Still leaving billions in profit.

That money can still provide for 2-3 billion "worth" of other PWA improvements, other emp. pay increases, new planes, profit sharing, more debt pay down, etc.

The company COULD afford most of this now, but "a contract is a contract".

With a stable industry and profits in the 1.5-2.5 billion per year range, that would mean about 2.4-3.4 billion per year in available funds.

IF the restoration of C2K rates will cost roughly 18-19mil per percentage point...63% (for restoration + COLA):

Cost $1.20 Billion roughly

Get DC to 18%: (4% more) ADD 80 mil

Roughly $1.28 billion per year rates/ret. ONLY

Using the corporate tan math from above, the "true cost" of this increase is

1.280bn x 65% = $832,000,000 per year.

Still leaving billions in profit.

That money can still provide for 2-3 billion "worth" of other PWA improvements, other emp. pay increases, new planes, profit sharing, more debt pay down, etc.

The company COULD afford most of this now, but "a contract is a contract".

#4019

Not sure where the graph put up by pineapple guy came from. His chart starts in 1983...we got our first Mad Dog in 87, and it was an MD82. I flew the first revenue trip on either the 29th or 30th of March

of that year. After we received 8 82s, the first one was returned and converted to an 88, followed by the other 7 as we received further 88s. We use to say that this was such a good job that we would do it for half pay...apparently you guys are.

of that year. After we received 8 82s, the first one was returned and converted to an 88, followed by the other 7 as we received further 88s. We use to say that this was such a good job that we would do it for half pay...apparently you guys are.

#4020

Gets Weekends Off

Joined APC: Feb 2008

Posts: 2,539

DAL wants debt to be at or under 10bill by 2012...when we actually are amendable (Jan. 2013) the debt will likely be in the 7.5-8 Billion range. That will represent roughly debt service savings of roughly $900 million per year....

With a stable industry and profits in the 1.5-2.5 billion per year range, that would mean about 2.4-3.4 billion per year in available funds.

The company COULD afford most of this now, but "a contract is a contract".

With a stable industry and profits in the 1.5-2.5 billion per year range, that would mean about 2.4-3.4 billion per year in available funds.

The company COULD afford most of this now, but "a contract is a contract".

I for one sure hope they hit the target. It would make for a much more survivable airline should there be any unplanned shocks to our system.

Thread

Thread Starter

Forum

Replies

Last Post

Lbell911

Regional

23

04-22-2012 11:33 AM