Details on Delta TA

#2962

Gets Weekends Off

Joined APC: Apr 2008

Position: DAL FO

Posts: 2,169

Gotta go with PD here. Can one of the mods edit T's post to remove the name? We mostly know who each other are, but that is by choice and up to each individual.

Let's not get into the outing game again here.

Let's not get into the outing game again here.

#2964

#2965

Good post, Carl. I guess maybe that's what it comes down to with the majority of us. I learned somewhere back around 2nd grade that there are times you just have to fight for yourself or you will continue to be bullied. Maybe the majority of this pilot group doesn't consider being compensated today at a level roughly comparable to the way we were compensated after taking a draconian pay cut in an extreme crisis as being bullied. Maybe the majority have accepted this "new reality"/standard for airline pilot compensation.

Management doesn't need to live with the negatives of being a bully. They've purchased ALPA for just that purpose. ALPA does the dirty work while management appears to be above it all and only interested in running a great airline. It's a brilliant strategy and a tactical success for management. The only question is, how long will pilots go along with the charade.

The last thing in the world I want to do is fight with our management. I want Delta Air Lines to be the most successful airline/company on the planet. And that is best accomplished by EVERYONE working together as a team to provide the very best product possible to our valued customers. But if you accept the premise that we are in fact being "bullied" by being compensated at a bankruptcy level when our industry has been restructured in such a positive way and our company is making such amazing profits, then it's quite possibly going to take a little standing up for ourselves to rectify that. I guess the majority, while many are not happy with the situation, are not willing to stand up and fight if necessary. How can our management respect us when we don't even demonstrate that we respect ourselves?

I'm clearly in the minority here, so I think I'll be joining tsquare in leaving this place (APC). If you guys decide at some point in the future to stand up for our profession, then you'll have my support (and I'll consider putting that ALPA pin back on). Otherwise, I'll continue voting no to any agreement that doesn't substantially restore our pay and I'll continue loving my job and giving it 110% just like I always do. That's about all I can do... I can't force anyone else to stand up for themselves. There's way more to life than money so I'm happy either way.

Carl

#2966

Gets Weekends Off

Thread Starter

Joined APC: Oct 2009

Posts: 3,108

In his most recent communication our MEC chairman committed to the best pilot contract in the world. My hat is off to him.

In my opinion we all need to ask our reps to provide data on all the major sections of the contracts at AF, KLM and Luftansa so we can compare them to our PWA.

Specifically defined benefit pensions, hourly rates, hours of service, vacation. Per diem, early retirement options, etc.

In my opinion we all need to ask our reps to provide data on all the major sections of the contracts at AF, KLM and Luftansa so we can compare them to our PWA.

Specifically defined benefit pensions, hourly rates, hours of service, vacation. Per diem, early retirement options, etc.

#2967

In his most recent communication our MEC chairman committed to the best pilot contract in the world. My hat is off to him.

In my opinion we all need to ask our reps to provide data on all the major sections of the contracts at AF, KLM and Luftansa so we can compare them to our PWA.

Specifically defined benefit pensions, hourly rates, hours of service, vacation. Per diem, early retirement options, etc.

In my opinion we all need to ask our reps to provide data on all the major sections of the contracts at AF, KLM and Luftansa so we can compare them to our PWA.

Specifically defined benefit pensions, hourly rates, hours of service, vacation. Per diem, early retirement options, etc.

#2968

Gets Weekends Off

Thread Starter

Joined APC: Oct 2009

Posts: 3,108

Delta Air Lines To Profit From Low Oil Price

Nov. 9, 2014 9:57 AM ET | 3 comments | About: Delta Air Lines, Inc. (DAL), Includes: AAL, LUV, UAL by: Alan Longbon

Summary

Current Situation

Since July 2014, the price of crude oil has been sliding steadily downwards.

The reasons for the recent decline in the price of oil are:

Historical Parallels

When one steps back further to the 1980s, one sees another more compelling argument that oil prices are going to go lower and also stay that way.

In the mid 1980s a similar scenario to today's oil price development played out. The OPEC countries were faced with falling prices which logically presented the argument to lower production; what developed, though, was a price war between OPEC members as each tried to retain their market share by pumping ever more volume. The price of oil fell from a high of $30 a barrel in 1985 to $10 a barrel in 1986. These low prices lasted for 15 years and only started rising to and over 1985 levels in 2000 as part of the Dotcom boom/bust. After a brief slump in 2001, oil went on to peak at over $145 a barrel at the top of the 2008 "GFC" land led boom/bust at the bottom of which it again saw $35 a barrel.

The same scenario is developing at present with the addition of alternate energy sources, US shale oil production and more efficient energy consumption technologies adding more downward oil price pressure not present in 1985.

If one steps still further back in time (1870 to 1911) to the days of US oil baron JD Rockefeller one sees a similar process in the continental USA where the competition was "sweated out" through price competition until only Rockefeller's Standard Oil company remained as a horizontally and vertically integrated monopoly. It took Rockefeller ten years to "sweat out" the competition and establish his monopoly. America enjoyed ten years of low oil prices while this ruinous competition took place.

Thus we have two historical parallels pointing to a decade of low oil prices. The key difference between the present situation and the 1980s to the Rockefeller era is that no monopoly will be formed, due to ruinous competition, for the following reasons:

1. An international oil market with many players.

2. Oil subsidies in an international market.

3. Only increased demand can drive the price back up as it did in 2000 and 2006.

Investing Opportunities

For the reasons listed and discussed above I see the oil price falling to about half its 2014 high and will be trading at around $50 a barrel for the next decade with many players being "sweated out" in the process. This development is hugely bullish for the world economy as a whole if not for the oil sector in particular.

To take advantage of this opportunity one would look to businesses that use a lot of oil products in their operations such as airlines who are the most oil price-sensitive businesses.

My focus is always on large, mega cap, top quality companies and for this reason the following companies have been singled out for more scrutiny as they stand to benefit most from a continuing low oil prices:

The chart for the 4 stocks is shown below.

All four stocks have shown strong growth over the last year indicating that the sector as a whole is strong at the moment after years of losses.

Just last year DAL had a massive $8b income tax write-off credited to its balance sheet and also shows three years of steady gains in all positive areas while costs stayed steady. An airline's biggest operating and most variable cost is fuel.

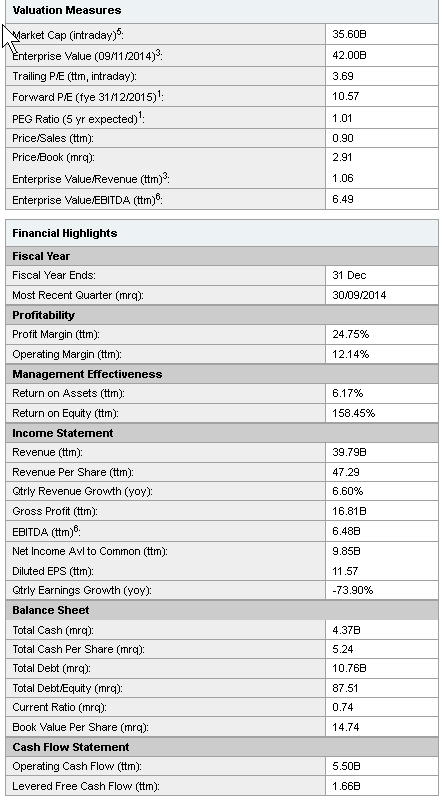

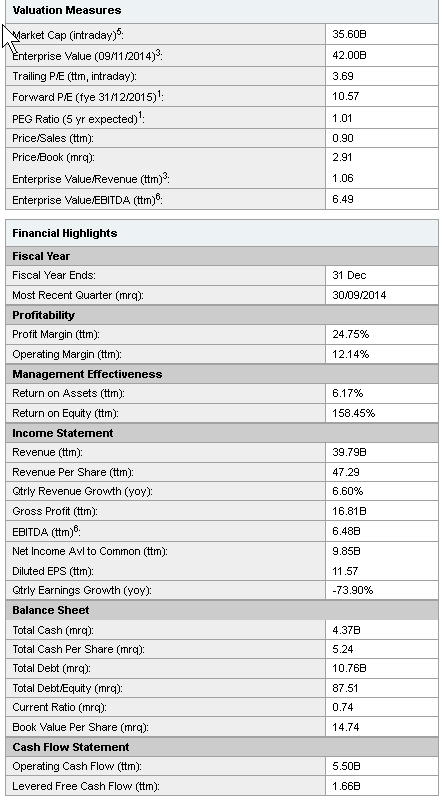

(click to enlarge)From a metric perspective DAL is displaying some very strong numbers which can only get better as the price of oil drops further:

Source: Yahoo Finance.

In a environment of falling oil prices, and therefore much lower operating costs which could last a decade, DAL offers outstanding value with a lot of upside future potential; some highlights are:

Based on the metrics as they are now, DAL is an outstanding stock offering good value for money. Oil is falling in price and I believe will reach about $50 per barrel and stay there for about ten years. This means that DAL's main operating cost will be cut in half. That will add an estimated $5b directly onto profits and make gross income increase by about 25% (DAL's fuel bill is about $10b per year). Increased earnings will capitalize into an increased share price.

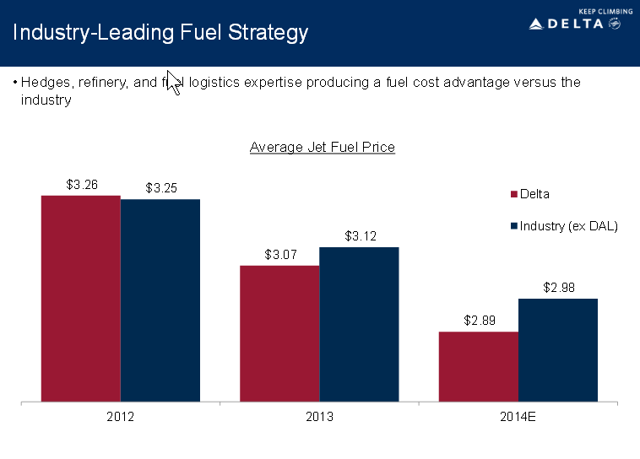

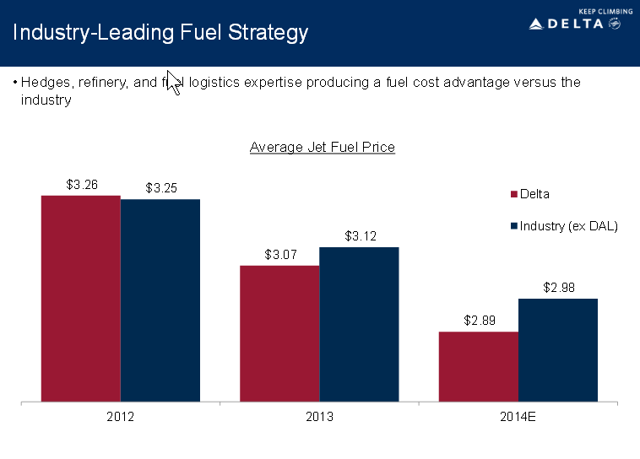

At present Delta has an industry-leading fuel-purchasing and hedging strategy. The chart below is taken from a presentation by Delta Air Lines made this month.

(click to enlarge)

Source: Delta Air Lines

From the chart one can see that Delta has strongly-falling fuel input prices and that these are industry wide but also that Delta is doing it better than its competitors.

All other things remaining equal, every dollar saved on fuel costs equates directly to more profitability.

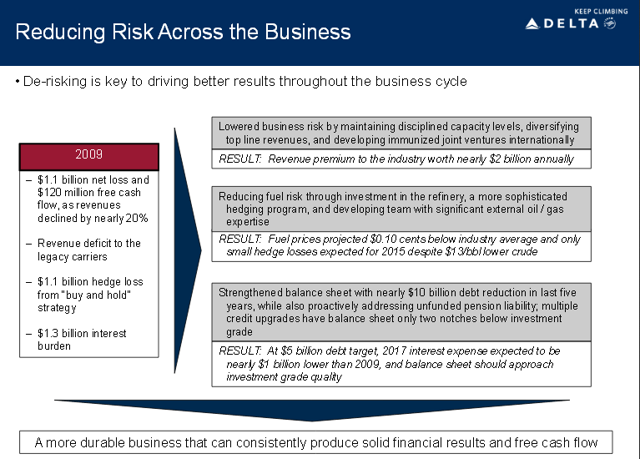

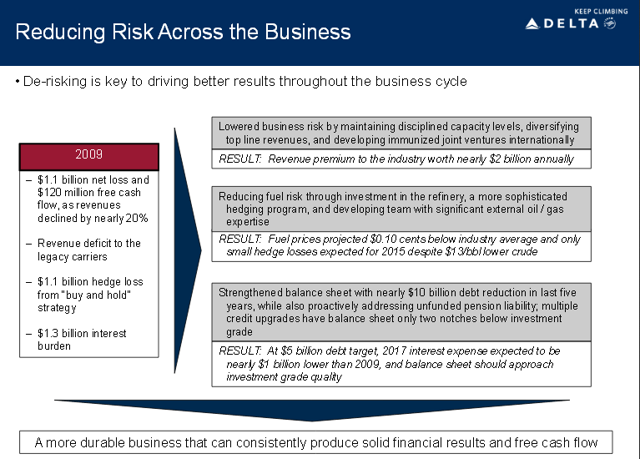

Delta is emerging from a massive restructure and rebuild that began in 2009 that is now bearing fruit. The presentation slide from Delta documents the progress very well.

(click to enlarge)

Source: Delta Air Lines.

The restructure and rebuild of the company together with a decade long period of low oil prices and a strengthening US economy bode very well for this business. On the next price retracement I will be going long Delta Air Lines for a long term hold up to the end of the decade.

Nov. 9, 2014 9:57 AM ET | 3 comments | About: Delta Air Lines, Inc. (DAL), Includes: AAL, LUV, UAL by: Alan Longbon

Summary

- Oil price heading for decade-long low prices, with historical parallels to oil industry developments in the 1980s and the Rockefeller era.

- Delta Air Lines emerging from massive restructuring and rebuilding phase, now pushed by low oil price tailwind to improve prospects even further.

- Every dollar saved on fuel by any airline adds directly to profitability.

Current Situation

Since July 2014, the price of crude oil has been sliding steadily downwards.

The reasons for the recent decline in the price of oil are:

- Increased oil supply, particularly from US shale oil production.

- Falling oil global demand.

- Rise of alternative energy sources such as solar and wind power.

- No reduction in supply as a response to falling global demand from traditional oil suppliers such as OPEC.

- More efficient energy consumption technology.

- Strength of the US$.

Historical Parallels

When one steps back further to the 1980s, one sees another more compelling argument that oil prices are going to go lower and also stay that way.

In the mid 1980s a similar scenario to today's oil price development played out. The OPEC countries were faced with falling prices which logically presented the argument to lower production; what developed, though, was a price war between OPEC members as each tried to retain their market share by pumping ever more volume. The price of oil fell from a high of $30 a barrel in 1985 to $10 a barrel in 1986. These low prices lasted for 15 years and only started rising to and over 1985 levels in 2000 as part of the Dotcom boom/bust. After a brief slump in 2001, oil went on to peak at over $145 a barrel at the top of the 2008 "GFC" land led boom/bust at the bottom of which it again saw $35 a barrel.

The same scenario is developing at present with the addition of alternate energy sources, US shale oil production and more efficient energy consumption technologies adding more downward oil price pressure not present in 1985.

If one steps still further back in time (1870 to 1911) to the days of US oil baron JD Rockefeller one sees a similar process in the continental USA where the competition was "sweated out" through price competition until only Rockefeller's Standard Oil company remained as a horizontally and vertically integrated monopoly. It took Rockefeller ten years to "sweat out" the competition and establish his monopoly. America enjoyed ten years of low oil prices while this ruinous competition took place.

Thus we have two historical parallels pointing to a decade of low oil prices. The key difference between the present situation and the 1980s to the Rockefeller era is that no monopoly will be formed, due to ruinous competition, for the following reasons:

1. An international oil market with many players.

2. Oil subsidies in an international market.

3. Only increased demand can drive the price back up as it did in 2000 and 2006.

Investing Opportunities

For the reasons listed and discussed above I see the oil price falling to about half its 2014 high and will be trading at around $50 a barrel for the next decade with many players being "sweated out" in the process. This development is hugely bullish for the world economy as a whole if not for the oil sector in particular.

To take advantage of this opportunity one would look to businesses that use a lot of oil products in their operations such as airlines who are the most oil price-sensitive businesses.

My focus is always on large, mega cap, top quality companies and for this reason the following companies have been singled out for more scrutiny as they stand to benefit most from a continuing low oil prices:

- Delta Air Lines (NYSE:DAL),

- America Airlines (NASDAQ:AAL),

- United Continental Holdings (NYSE:UAL), and

- Southwest Airlines Co (NYSE:LUV)

The chart for the 4 stocks is shown below.

All four stocks have shown strong growth over the last year indicating that the sector as a whole is strong at the moment after years of losses.

Just last year DAL had a massive $8b income tax write-off credited to its balance sheet and also shows three years of steady gains in all positive areas while costs stayed steady. An airline's biggest operating and most variable cost is fuel.

(click to enlarge)From a metric perspective DAL is displaying some very strong numbers which can only get better as the price of oil drops further:

Source: Yahoo Finance.

In a environment of falling oil prices, and therefore much lower operating costs which could last a decade, DAL offers outstanding value with a lot of upside future potential; some highlights are:

- Enterprise value is 16.6% below market cap.

- Forward P/E of over 10.

- ROE an amazing 158%

Based on the metrics as they are now, DAL is an outstanding stock offering good value for money. Oil is falling in price and I believe will reach about $50 per barrel and stay there for about ten years. This means that DAL's main operating cost will be cut in half. That will add an estimated $5b directly onto profits and make gross income increase by about 25% (DAL's fuel bill is about $10b per year). Increased earnings will capitalize into an increased share price.

At present Delta has an industry-leading fuel-purchasing and hedging strategy. The chart below is taken from a presentation by Delta Air Lines made this month.

(click to enlarge)

Source: Delta Air Lines

From the chart one can see that Delta has strongly-falling fuel input prices and that these are industry wide but also that Delta is doing it better than its competitors.

All other things remaining equal, every dollar saved on fuel costs equates directly to more profitability.

Delta is emerging from a massive restructure and rebuild that began in 2009 that is now bearing fruit. The presentation slide from Delta documents the progress very well.

(click to enlarge)

Source: Delta Air Lines.

The restructure and rebuild of the company together with a decade long period of low oil prices and a strengthening US economy bode very well for this business. On the next price retracement I will be going long Delta Air Lines for a long term hold up to the end of the decade.

#2969

Gets Weekends Off

Thread Starter

Joined APC: Oct 2009

Posts: 3,108

If this guy is half right, we will see profit sharing between 30% and 70% for the next decade.

I think he is spot on and this is the best article written to date on the future of oil.

To reduce profit sharing would be the biggest mistake of our careers.

I think he is spot on and this is the best article written to date on the future of oil.

To reduce profit sharing would be the biggest mistake of our careers.

#2970

Gets Weekends Off

Joined APC: Jun 2009

Posts: 5,113

Thread

Thread Starter

Forum

Replies

Last Post