Any "Latest & Greatest" about Delta?

Gets Weekends Off

Joined APC: Aug 2010

Posts: 2,530

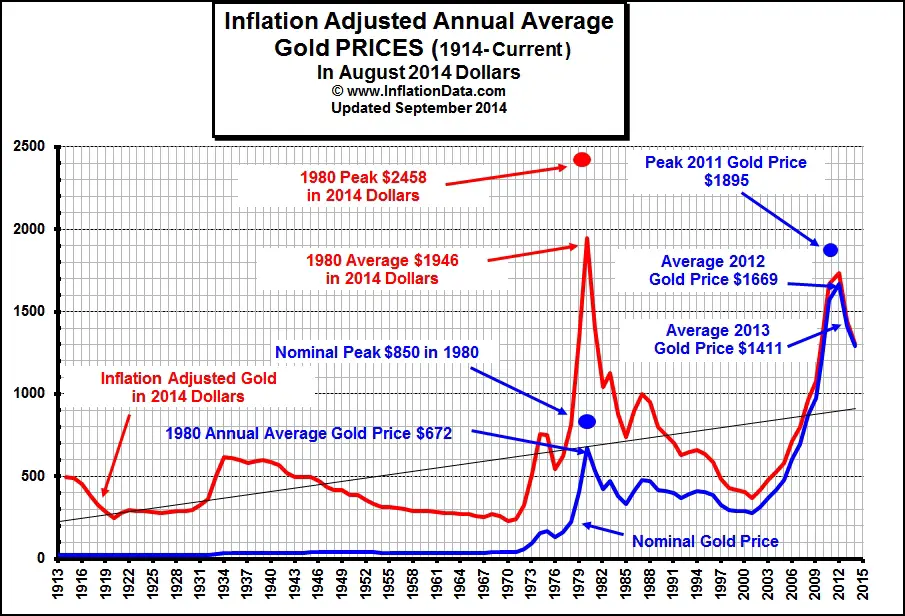

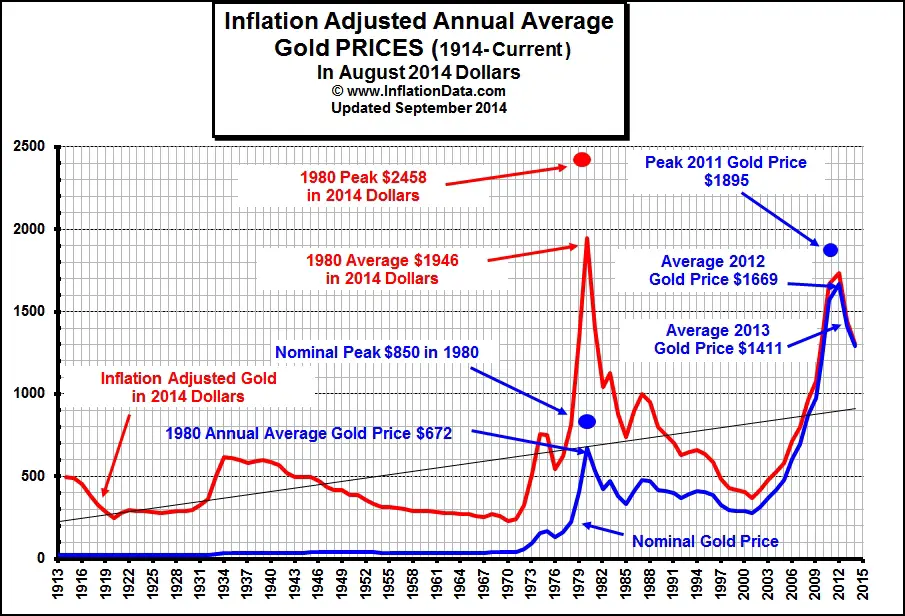

Not sure exactly what youre asking, but when something is on an epic bull run over a sustained period of time there will always be dips. This most recent one was largely because foreign central banks did a lot of dumping of their real wealth to help kick their debt can down the road a bit by selling off massive gold holdings. Something the "gold bugs" have been very openly predicting would happen anyway, thus the periodic and swift price drops.

Higher highs and higher lows.

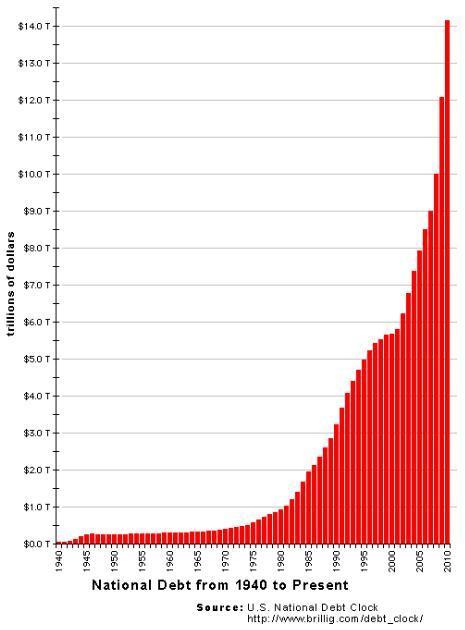

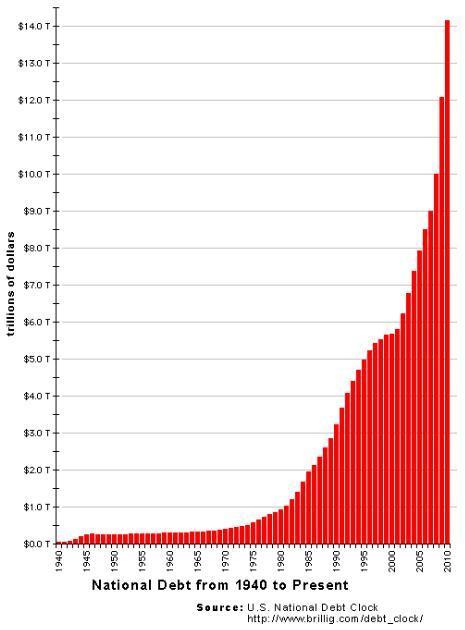

Exclude the blip in the early 80's, when we decided to mask the problem with exploding debt under the Keynesian fantasy of permanent reserve currency monetizers with no end or challenge, and its easy to see where the trend is going.

Especially when there is massive resistance to slight decreases in the rate of acceleration into the debt crisis we will have to endure.

You won't find one filthy rich person in the world that doesn't have 5-10% in metals at any given time, yet the "small fry" investor is looked down by the paper money/day trader/"Snyder Method" crowd for taking pretty much any position. Diverse investors who dollar cost average into long metals positions, particularly if they emply even a nominal amount of arbitrage by buying the dips, have done and will continue to do just fine with their metals position.

That said, there probably are a few folks who made big moves into the peaks and sold in a panic at the dips. But that can be said for every single stock and asset class in existence. People are selling APPL today who bought at 700+ and vice versa. Diversification is mandatory, and no investor is truly diverse without some level of a position in metals. The rich, banks and nations all do it without question, yet its somewhat taboo for the little guy who for some reason is expected to be 100% in fiat otherwise he's a fool when the inevitable dips happen.

Higher highs and higher lows.

Exclude the blip in the early 80's, when we decided to mask the problem with exploding debt under the Keynesian fantasy of permanent reserve currency monetizers with no end or challenge, and its easy to see where the trend is going.

Especially when there is massive resistance to slight decreases in the rate of acceleration into the debt crisis we will have to endure.

You won't find one filthy rich person in the world that doesn't have 5-10% in metals at any given time, yet the "small fry" investor is looked down by the paper money/day trader/"Snyder Method" crowd for taking pretty much any position. Diverse investors who dollar cost average into long metals positions, particularly if they emply even a nominal amount of arbitrage by buying the dips, have done and will continue to do just fine with their metals position.

That said, there probably are a few folks who made big moves into the peaks and sold in a panic at the dips. But that can be said for every single stock and asset class in existence. People are selling APPL today who bought at 700+ and vice versa. Diversification is mandatory, and no investor is truly diverse without some level of a position in metals. The rich, banks and nations all do it without question, yet its somewhat taboo for the little guy who for some reason is expected to be 100% in fiat otherwise he's a fool when the inevitable dips happen.

Gold Seen Crushed as Credit Suisse Forecasts $1,100 in Year - Bloomberg

Gold Seen Crushed as Credit Suisse Forecasts $1,100 in Year

Gold, down 17 percent since January, is poised to lose 20 percent in a year as inflation remains subdued amid low growth rates and risks of bad events diminish, Credit Suisse Group AG said.

Gold will trade at $1,100 an ounce in a year and below $1,000 in five years, according to Ric Deverell, head of commodities research at the bank. Lower prices are unlikely to lure more central-bank buying, said Deverell, who worked at the Reserve Bank of Australia for 10 years before joining Credit Suisse in 2010.

Combined gold reserves held by central banks have risen to an eight-year high as nations from Russia to Kazakhstan to Mongolia expanded holdings, the International Monetary Fund data show.

“Gold is going to get crushed,” Deverell told reporters in London today. “The need to buy gold for wealth preservation fell down and the probability of inflation on a one- to three-year horizon is significantly diminished.”

Gold prices that reached a record in 2011 tumbled into a bear market last month, breaking a 12-year bull market. Bullion for immediate delivery traded at $1,383.35 by 4:39 p.m. in London.

Gold may slip to $1,350 in the next couple weeks, Deverell said. Bullion is still too expensive relative to other “real assets” such as base metals, according to Credit Suisse.

While central banks have a broad strategic plan to diversify reserves, their managers wouldn’t want to lose money if gold enters a period of declines, Deverell said.

Combined gold reserves held by central banks have risen to an eight-year high as nations from Russia to Kazakhstan to Mongolia expanded holdings, the International Monetary Fund data show. The banks bought 534.6 metric tons last year, the most since 1964, and may add as much as 550 tons in 2013, the World Gold Council estimates.

“When gold is going up, it looks like a great idea to buy more gold,” Deverell said. “And when it’s going down, do you really think risk-averse central bankers are going to try and catch the knife? No.”

Gets Weekends Off

Joined APC: Jul 2010

Position: window seat

Posts: 12,544

Here's the flip side to that:

Gold Seen Crushed as Credit Suisse Forecasts $1,100 in Year - Bloomberg

Gold Seen Crushed as Credit Suisse Forecasts $1,100 in Year

Gold, down 17 percent since January, is poised to lose 20 percent in a year as inflation remains subdued amid low growth rates and risks of bad events diminish, Credit Suisse Group AG said.

Gold will trade at $1,100 an ounce in a year and below $1,000 in five years, according to Ric Deverell, head of commodities research at the bank. Lower prices are unlikely to lure more central-bank buying, said Deverell, who worked at the Reserve Bank of Australia for 10 years before joining Credit Suisse in 2010.

Combined gold reserves held by central banks have risen to an eight-year high as nations from Russia to Kazakhstan to Mongolia expanded holdings, the International Monetary Fund data show.

“Gold is going to get crushed,” Deverell told reporters in London today. “The need to buy gold for wealth preservation fell down and the probability of inflation on a one- to three-year horizon is significantly diminished.”

Gold prices that reached a record in 2011 tumbled into a bear market last month, breaking a 12-year bull market. Bullion for immediate delivery traded at $1,383.35 by 4:39 p.m. in London.

Gold may slip to $1,350 in the next couple weeks, Deverell said. Bullion is still too expensive relative to other “real assets” such as base metals, according to Credit Suisse.

While central banks have a broad strategic plan to diversify reserves, their managers wouldn’t want to lose money if gold enters a period of declines, Deverell said.

Combined gold reserves held by central banks have risen to an eight-year high as nations from Russia to Kazakhstan to Mongolia expanded holdings, the International Monetary Fund data show. The banks bought 534.6 metric tons last year, the most since 1964, and may add as much as 550 tons in 2013, the World Gold Council estimates.

“When gold is going up, it looks like a great idea to buy more gold,” Deverell said. “And when it’s going down, do you really think risk-averse central bankers are going to try and catch the knife? No.”

Gold Seen Crushed as Credit Suisse Forecasts $1,100 in Year - Bloomberg

Gold Seen Crushed as Credit Suisse Forecasts $1,100 in Year

Gold, down 17 percent since January, is poised to lose 20 percent in a year as inflation remains subdued amid low growth rates and risks of bad events diminish, Credit Suisse Group AG said.

Gold will trade at $1,100 an ounce in a year and below $1,000 in five years, according to Ric Deverell, head of commodities research at the bank. Lower prices are unlikely to lure more central-bank buying, said Deverell, who worked at the Reserve Bank of Australia for 10 years before joining Credit Suisse in 2010.

Combined gold reserves held by central banks have risen to an eight-year high as nations from Russia to Kazakhstan to Mongolia expanded holdings, the International Monetary Fund data show.

“Gold is going to get crushed,” Deverell told reporters in London today. “The need to buy gold for wealth preservation fell down and the probability of inflation on a one- to three-year horizon is significantly diminished.”

Gold prices that reached a record in 2011 tumbled into a bear market last month, breaking a 12-year bull market. Bullion for immediate delivery traded at $1,383.35 by 4:39 p.m. in London.

Gold may slip to $1,350 in the next couple weeks, Deverell said. Bullion is still too expensive relative to other “real assets” such as base metals, according to Credit Suisse.

While central banks have a broad strategic plan to diversify reserves, their managers wouldn’t want to lose money if gold enters a period of declines, Deverell said.

Combined gold reserves held by central banks have risen to an eight-year high as nations from Russia to Kazakhstan to Mongolia expanded holdings, the International Monetary Fund data show. The banks bought 534.6 metric tons last year, the most since 1964, and may add as much as 550 tons in 2013, the World Gold Council estimates.

“When gold is going up, it looks like a great idea to buy more gold,” Deverell said. “And when it’s going down, do you really think risk-averse central bankers are going to try and catch the knife? No.”

I would hope that no one is going "all in" to metals at any price. No one should go all in to anything at any price. Diversity is vital, especially in an era of what appears to be a "new normal" for perpetual volitility. If someone was looking into taking a sudden, large metals position for whatever reason, I'd recommend they not do it right now and wait a bit for the money to flow out of metals and into the current bubble, which is one of the biggest we've ever seen.

That said, this price point is a reasonable buying opportunity for a reasonable dollar cost average position in a long term position of a reasonable percentage (5-10% now, maybe slowly working up to 10-20% as this bubble crisis in the making inflates, depending on other factors and how you time it).

Remember, we're talking DCA'ing into reasonable long positions in a diversified portfolio here, not day traders, flippers, callers and putters. DCA'ing by slowly and steadily buying the dips IMHO is a very prudent part of a secure long term position. If the "knife" really does fall though and we see gold well below 1000, maybe even below 500, I'd say go long, big and hard. Wait, that's what who said?

Gets Weekends Off

Joined APC: Jun 2007

Position: 7ER Capt

Posts: 461

Wrt running to HR... Seriously? HR is required to bring in Delta legal on this type of issue... the offender Will lose his/her job...(or at a minimum, a very large stain on their record... i.e., better not have any other issues in your career).

How about this instead... have the stones to say something to his/her face... I've done it... not that difficult.

In 25yrs, I've not once considered turning in a fellow pilot for what he/she said/thought... would not want someone fired because they're a jerk.

I've seen this "turning in" behavior with FAs over the years, but never with Flt Deck crew... hope we haven't come to this in our profession.

How about this instead... have the stones to say something to his/her face... I've done it... not that difficult.

In 25yrs, I've not once considered turning in a fellow pilot for what he/she said/thought... would not want someone fired because they're a jerk.

I've seen this "turning in" behavior with FAs over the years, but never with Flt Deck crew... hope we haven't come to this in our profession.

Runs with scissors

Joined APC: Dec 2009

Position: Going to hell in a bucket, but enjoying the ride .

Posts: 7,738

Yea, mine shows me on call the first 9 days, off one and another 5 days on call. Then I have 10 days off at the end of the month. I think the PCS run is screwed up since the pilot one number below me got off the Saturday that I had as my first choice and I didn't get it off. It still doesn't show up in iCrew and PCS is locked.

Does the pilot one below you have a partial month for a training event etc? I had this happen a few months ago and I really needed the day off. I was told it was because they had to make a legal line for a pilot with a MMC and because of that, they can "coverage award" me a day where they did not have to do the same to them.

Have questions email the PBS folks.

Gets Weekends Off

Joined APC: Oct 2010

Position: Decoupled

Posts: 922

Columbia,

I haven't been suckered into the gold bubble. However, it's not a bad idea to own some precious metals, maybe 5% of overall portfolio in a precious metal position.

As to the call selling hype, selling covered calls is a time honored, successful investment strategy or tool that can be employed across a universe of investments. It's an exceptional investment tool in a bull market.

If you don't understand how to use this tool, educate yourself. I have done exceedingly well and couldn't be happier.

Gets Weekends Off

Joined APC: Oct 2010

Position: Decoupled

Posts: 922

You won't find one filthy rich person in the world that doesn't have 5-10% in metals at any given time, yet the "small fry" investor is looked down by the paper money/day trader/"Snyder Method" crowd for taking pretty much any position. Diverse investors who dollar cost average into long metals positions, particularly if they emply even a nominal amount of arbitrage by buying the dips, have done and will continue to do just fine with their metals position.

That said, there probably are a few folks who made big moves into the peaks and sold in a panic at the dips. But that can be said for every single stock and asset class in existence. People are selling APPL today who bought at 700+ and vice versa. Diversification is mandatory, and no investor is truly diverse without some level of a position in metals. The rich, banks and nations all do it without question, yet its somewhat taboo for the little guy who for some reason is expected to be 100% in fiat otherwise he's a fool when the inevitable dips happen.

Point of information: The Snider Method is not a day trading vehicle. It is a monthly covered call strategy that involves a methodical way of dollar cost averaging and forced profit taking. It can invest in metals as ETF's or miners if diversified. Yes, those investments are paper. But, AAPL and IBM are paper, too. Additionally, if you were good at it, day trading can be a profitable venture, too. Most people have neither the time nor interest to learn how to do it properly.

But, I don't believe in the end of the fiat banking system. The military industrial complex will never let that happen. Time will tell.

Can't abide NAI

Joined APC: Jun 2007

Position: Douglas Aerospace post production Flight Test & Work Around Engineering bulletin dissembler

Posts: 12,038

Good grief, I apologize for my "juvenile" comments....I was just trying to be funny....just as I was when I posted the pic of the hot Santa dude. If you don't want to be offended by the guy talk in our virtual "bar" then don't come here for your beer. Sheesh. I'm probably the only pole smoker on here and I post 1 picture a year, I don't get offended by underboob the other 364 days a year. This is all in fun and a great place to swap lies and rumors. Lighten up just a bit, life is more fun that way

Your own advice.

A lot of what's called homophobia isn't. Perhaps bigotry is a better way to describe some peoples' reactions to having a somewhat organized group aggressively force their sexual opinions on them. Venting is mostly a reaction to observations like the nude male bag tags I've seen on a NY Based A line's luggage and our corporation's own sponsorship of a program which sends adults to middle schools to talk to children about sexuality. Where I come from both are highly inappropriate, but are accepted.

Two wrongs don't make a right. In fact, two wrongs on the flight deck is likely a violation, or a safety event. I prefer the Braves to the Yankees and some years I am passionate about that distinction, but, I could care less as long as that other pilot speaks up at the right time to keep us both out of trouble.

IMHO, hypersensitivity to anything is an invitation to distraction. I keep my scope issues here on a web board. I invite you to do the same with whatever issues you might have a particular concern about. This is a better place to fix the World's problems than a flight deck, or heaven forbid with HR.

I strongly believe it is wrong to try to harm a fellow pilot because your opinions are different from theirs ... and at the end of the day, what you describe is a matter of opinion; two extreme views on what is unacceptable behavior.

Thread

Thread Starter

Forum

Replies

Last Post